CLEAN HYDROGEN PRODUCTION TAX CREDIT, EXPLAINED PART 3

Once power reaches the grid, the electrons are inherently fungible (hence this post’s title). Yet, tracking how, when, and where the power was generated is critical to determining its carbon intensity, which is necessary to calculate a project’s 45V clean hydrogen production tax credit (45V PTC).

In Part 1 of this series on the 45V PTC, we explore what it means to be “clean hydrogen”. In Part 2, we introduce the concept of lifecycle analysis.

In this post, we turn our attention to the emissions from power generation.

The Recap

The 2022 Inflation Reduction Act (IRA) created a new 45V PTC for clean hydrogen. The tiered tax credit amount offers lower carbon intensity hydrogen a higher credit. The lowest tier (up to $0.60 per kg) requires a carbon intensity of less than four kg of CO2e per kg of hydrogen. The highest tier (up to $3.00 per kg) requires the carbon intensity to be less than 0.45 kg CO2e per kg of hydrogen.

The GREET model assesses lifecycle emissions on a well-to-gate basis, which considers emissions from the production process, power generation and supply, feedstock supply chain and carbon capture.

Carbon Intensity of the Power Grid

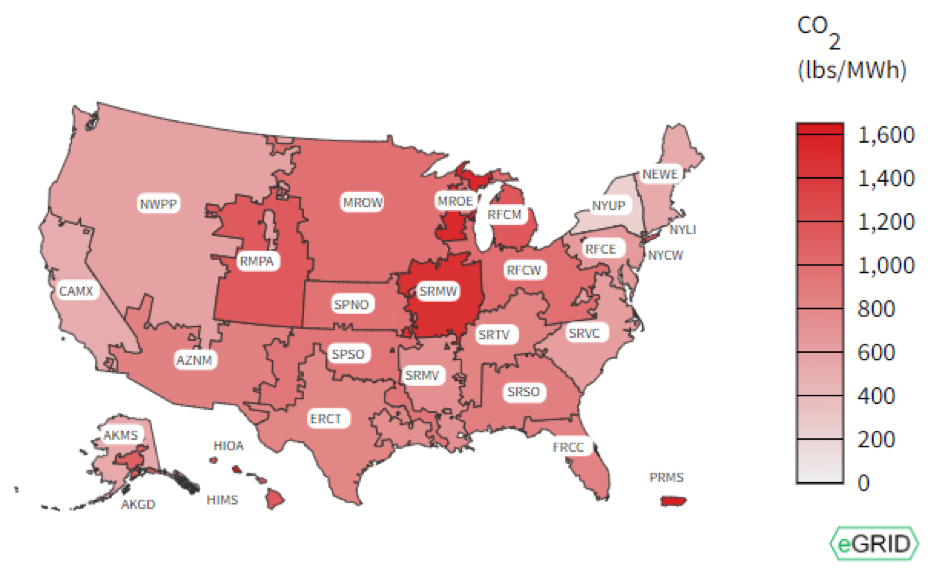

The U.S. power grid’s carbon intensity varies considerably by region, depending on the local mixture of power generation sources (see Figure 1).

Figure 1 – Grid Power Intensity by Region1

According to the EPA, upstate New York’s grid has the country’s lowest carbon intensity, with much of its power supplied by nuclear and hydroelectric sources. Wisconsin’s power grid, at the other end of the spectrum, is over six times more carbon intensive – with nearly 90% of the power supplied by natural gas and coal. The national average is about 818 lbs of CO2e per MWh.

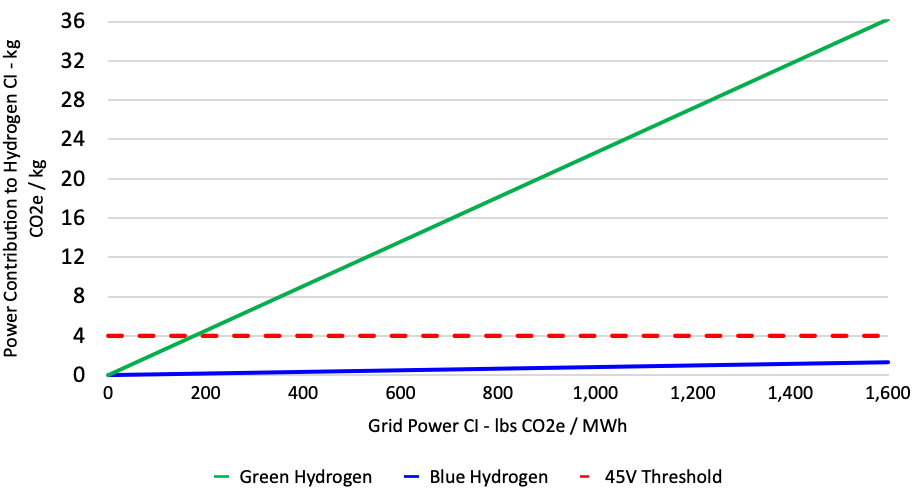

Given the power intensive nature of green hydrogen production, its carbon intensity is highly sensitive to the emissions from electricity generation (see Figure 2). For green hydrogen to meet the 45V PTC carbon intensity threshold of 4 kg CO2e per kg of hydrogen, renewable power sources are essentially required.

Blue hydrogen, on the other hand, is much less sensitive to power emissions – with the natural gas supply and the hydrogen production process responsible for the lion’s share of its overall carbon intensity.

Figure 2 – Power Contribution to Hydrogen Carbon Intensity2

The Proximity Questions

Utility-scale solar and wind farms typically require significant acreage and are primarily located in rural or isolated areas. Hydrogen demand, however, tends to be concentrated in industrial areas.

As a result, co-locating renewable power production with green hydrogen production is often impractical – or at least non-ideal, creating increased transportation costs to move hydrogen from remote areas to end users.

If renewable power often won’t be located next to green hydrogen production, the IRS will likely need to allow virtual power purchase agreements (VPPAs), which enable users to purchase electricity from a power plant not physically connected to it. VPPAs are widely utilized today for solar and wind projects.

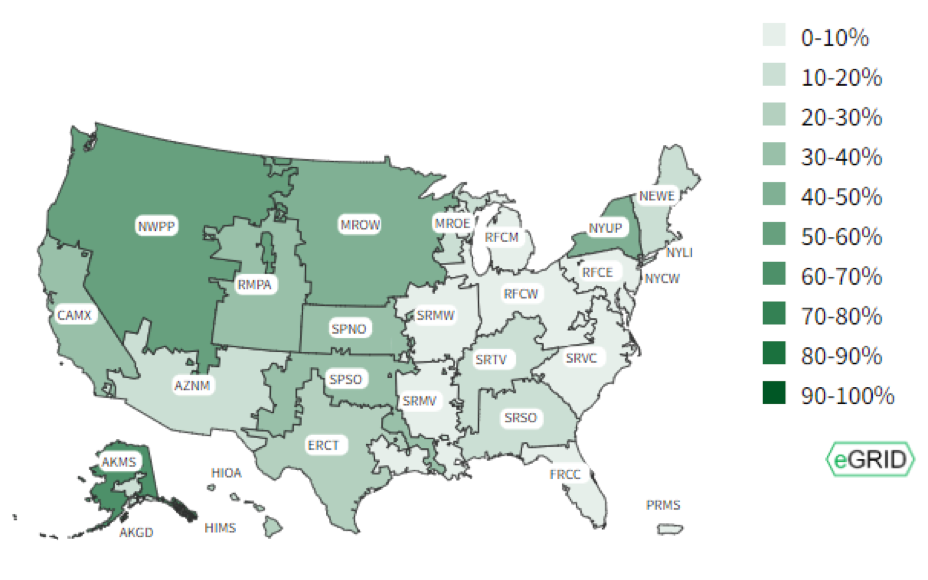

If the IRS allows VPPAs, one question that arises is: how far away can the power generation be from the hydrogen production? The U.S. renewable power mix varies greatly by region (see Figure 3), as does the price of electricity. Could a green hydrogen facility in Pennsylvania (which has 5% renewable power) use power generated in California (which has 40%)?

Figure 3 – Renewable Power Mix by Region2

The IRS posed this proximity question in its November Request for Comments3 . Many comment letters propose restricting VPPAs to the same “region” for purposes of 45V PTC determination, with region perhaps defined by the existing Independent System Operator (ISO) boundaries..

The Time Matching Questions

Another major question (assuming IRS allows VPPAs) is what time matching requirements will be imposed? In other words, how precisely must the time of power generation align with the time of hydrogen generation?

Time matching hinges on the concept of “capacity factor”, which measures how often a power generator operates at full capacity. For example, a 100-megawatt (MW) power plant producing 2,400 megawatt-hours (MWh) in a 24-hour period would have a 100% capacity factor for that day.

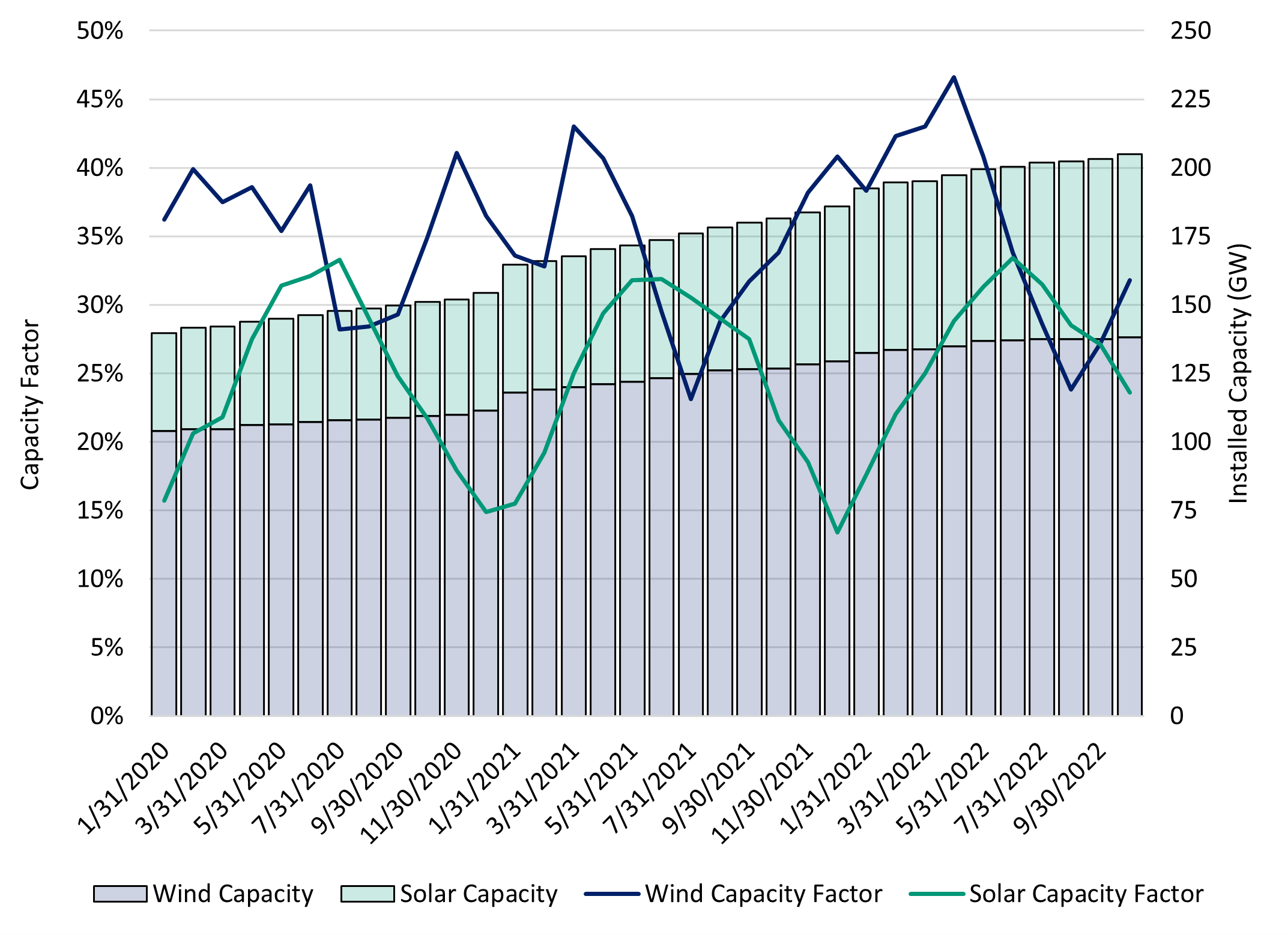

Natural gas, coal, nuclear, and hydroelectric power plants have high capacity factors because they operate continuously. On the other hand, wind and solar are much lower (see Figure 4).

Figure 4 – Capacity and Capacity Factors for U.S. Solar and Wind4

In 2020-21, the average capacity factor for U.S. wind power was about 35%, and solar was about 24%, according to the EIA. Combining wind and solar helps, as it’s often windy when it’s not sunny. But even the combined capacity factor is far below 100% (at least in a single area). Capacity factors also fluctuate by season, particularly for solar.

Hence the question of time matching requirements. Many comment letters submitted to the IRS propose an annual time matching requirement. In other words, a green hydrogen producer calculates how much power they consumed for the entire year and simply needs to buy that quantity of renewable power – regardless of the day and time the power was generated.

Annual time matching would be generous for the green hydrogen industry. For example, one could argue that this would allow the production of green hydrogen at 2 a.m. on Thanksgiving morning using solar power generated at noon on Memorial Day.

Other commenters propose more restrictive requirements, with hourly or even sub-hourly time matching. If more restrictive time-matching requirements are imposed, green hydrogen producers will have options to deal with renewable power’s low capacity factor. These might include:

- Increase the capacity factor by installing power storage (e.g., batteries) or purchasing electricity from a supplier that’s utilizing power storage.

- Only produce hydrogen when renewable power is available (and shut down when it’s not). Potentially add hydrogen storage capacity to allow for consistent delivery rates to the customer.

- Produce green hydrogen when renewable power is available and non-green hydrogen when it’s not.

Clever hydrogen developers are probably concocting additional solutions. Regardless, any of the options would have a significant impact on project economics, highlighting the importance of the time matching question.

The Recs

The IRS may also allow hydrogen producers to purchase local grid power but offset the emissions with Renewable Energy Certificates (RECs). Not to be confused with carbon offsets, RECs are the accepted legal instrument for tracking renewable energy generation in the U.S.

A unique REC is created for each MWh of renewable electricity generated and delivered to the grid. Purchasers of renewable electricity typically – but not always – receive the RECs associated with the renewable power they’re buying. In other cases, RECs are decoupled from the underlying power and sold separately.

An established market exists for RECs, with buyers, sellers, and brokers actively trading various flavors of RECs depending on the location of the power plant, the timeframe generated and other factors.

In any scenario, the final REC purchaser ultimately “retires” it, allowing them to officially claim the environmental benefit (a reduction in their overall emissions).

It remains to be seen whether the IRS will accept RECs to offset power generation emissions. Even if they do accept RECs, the IRS will still need to address the proximity and time matching questions to define which particular RECs could be used for a project.

The Summary

The purchase and sale of renewable power can be a complicated subject. Fortunately, developers of solar, wind and battery projects are already well-versed in the nuances. Once the IRS answers some of these key questions, we expect that savvy developers will quickly adjust their projects and be off to the races.

Contact us to discuss more.

Disclaimer:

The information in this blog has been provided by S&B for general information purposes. It does not constitute legal, accounting, tax or other professional advice or services and is presented without any representation or warranty as to the accuracy or completeness of the information. For advice relative to any of the categories stated, recipients should consult their own attorneys, accountants, or other professional advisors.

[1] Figure 1 Source: EPA Power Profiler; www.epa.gov/egrid/power-profiler

[2] Figure 3 Source: EPA Power Profiler; www.epa.gov/egrid/power-profiler

[3] IRS Notice 2022-58; irs.gov/pub/irs-drop/n-22-58.pdf

[4] Figure 4 Source: EIA Electric Power Monthly; www.eia.gov/electricity/monthly, Table 6.07.B